Twenty-Five Companies Rewiring Power for the Compute Age

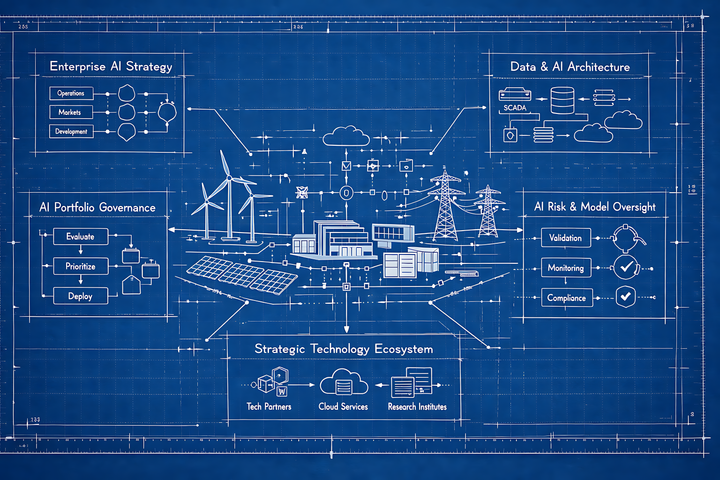

These 25 companies that span supply creation, grid intelligence, demand flexibility, and hyperscaler strategy are reengineering the global power system to match the unprecedented speed and scale of the AI era.