The Utility-AI Value Framework

The Utility AI Value Framework helps utilities prioritize AI and GenAI by scoring reliability, renewables, cost, customer, compliance, and innovation. With 25 key use cases, it shows how priorities differ by utility type and context, while stressing data quality, workforce, and governance.

Throughout history, the electric utility has been a crucible of transformation. The birth of centralized power plants in the late nineteenth century was followed by the slow march of electrification, connecting urban cores and rural farms alike. Later came the rise of Supervisory Control and Data Acquisition (SCADA) systems in the 1960s and 1970s, introducing the first digital nerve endings into a previously analog industry. Each shift required utilities to rethink not only their technologies but also their operating philosophies.

Today, we stand at a similar inflection point. The forces reshaping the sector—renewable integration, electrification of transport, surging data-center demand, decarbonization mandates, and climate resilience—coincide with the maturation of artificial intelligence (AI) and generative AI (GenAI). This confluence invites a new way of thinking: how can utilities systematically evaluate, prioritize, and implement AI-driven applications to maximize both business value and social good?

What follows is a conceptual value framework for aligning AI and GenAI applications with utility objectives. It is not a prescriptive model but a compass: a way for utilities to rank initiatives, balance short-term wins with long-term transformation, and adapt to shifting regulatory and market realities.

Why AI, and Why Now?

The urgency arises from converging pressures. Electricity demand in the United States is projected to grow at roughly 5 percent annually through 2030, a marked reversal from the flat demand of the previous two decades, largely due to electric vehicles and hyperscale data centers. [1] Renewable penetration in some regions already exceeds 50 percent during peak hours, challenging grid stability. Meanwhile, utilities face rising capital costs, intensifying extreme weather, and regulators demanding both decarbonization and affordability.

AI offers leverage across this complexity. Predictive maintenance algorithms can reduce downtime and extend asset life. Demand forecasting models can balance intermittent renewables with battery dispatch. Generative AI can synthesize regulatory filings, accelerate customer engagement, and even generate optimized control code for distributed resources. Yet the spectrum of possibilities also creates a dilemma: which initiatives matter most, and how should they be ranked?

The sheer diversity of potential AI and GenAI applications in the utility sector makes prioritization a formidable task. From predictive maintenance and vegetation management to customer-facing chatbots and regulatory automation, each use case promises some combination of efficiency gains, resilience benefits, or enhanced customer value. Yet utilities operate in a dynamic environment where pressures vary—an IOU facing competitive markets will not weigh the same priorities as a municipal utility striving for community trust, nor will a wildfire-prone California utility mirror the calculus of a Midwestern co-op. The abundance of possibilities underscores the need for structured frameworks that can sort, score, and rank initiatives in a way that reflects both universal industry goals and the unique imperatives of each utility.

Top Utility AI Applications

The sheer breadth of AI applications now emerging for utilities reflects just how deeply these technologies can touch every layer of the business. Some are operationally focused—like predictive maintenance, fault detection, and vegetation management—aimed at keeping assets healthy and minimizing outage risk. Others target system-level optimization, from dynamic line rating and demand forecasting to virtual power plants and grid digital twins, reshaping how electricity flows across increasingly complex networks. Still others push into the commercial and regulatory frontier: energy trading algorithms, GenAI for compliance filings, or customer-facing chatbots that redefine engagement. The diversity underscores a central tension: with so many viable use cases spanning reliability, decarbonization, cost control, and customer experience, utilities must make deliberate choices about where to begin, and how to sequence investments in an environment where the technological frontier shifts faster than the regulatory one.

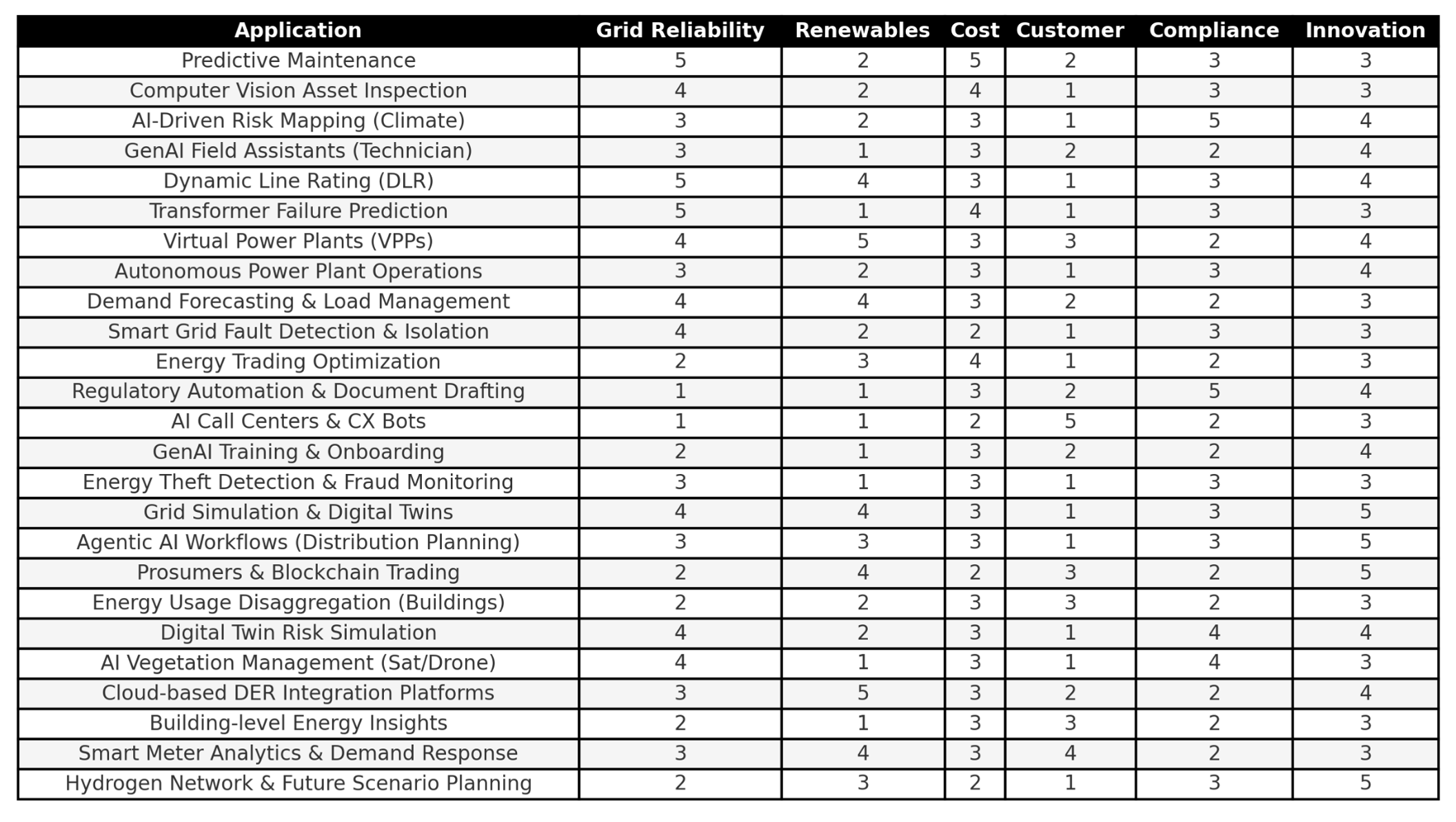

Table 1 presents a curated list of 25 high‑potential AI and GenAI applications tailored to electric utilities in the United States—drawn from recent reports, industry pilots, expert analyses, and academic developments.

Table 1

| # | Application | Description |

|---|---|---|

| 1 | Predictive Maintenance | AI monitors transformer networks and equipment to anticipate failures before they happen. |

| 2 | Computer Vision Asset Inspection | Automated image-analysis of power lines and substations to expedite field monitoring. |

| 3 | AI-Driven Risk Mapping for Climate Threats | Platforms like Rhizome map pole-level wildfire and storm risks to guide preventive investments. |

| 4 | Generative AI Field Assistants | Tools like Avangrid’s “First Time Right Autopilot” support real-time technician troubleshooting. |

| 5 | Dynamic Line Rating (DLR) | Real-time weather-based line capacity forecasting, boosting transmission throughput 30%. |

| 6 | Transformer Failure Prediction | AI sensors forecast failures to maintain continuous operations. |

| 7 | Virtual Power Plants (VPPs) | Aggregating storage, EVs, and DERs to supply grid services efficiently. |

| 8 | Autonomous Power Plant Operations | Real-time hazard detection through sensor networks reduces human risk. |

| 9 | Demand Forecasting & Load Management | AI predicts energy use and dynamically controls DERs to ease peak loads. |

| 10 | Smart Grid & Fault Detection | AI enhances grid awareness for quicker fault isolation and restoration. |

| 11 | Energy Trading Optimization | AI algorithms optimize procurement timing and pricing in volatile markets. |

| 12 | Regulatory Automation & Document Drafting | GenAI auto-generates regulatory filings and compliance reports. |

| 13 | Enhanced Call Center AI | GenAI improves customer support via human-like chat, reducing handle time. |

| 14 | Technician Onboarding & Training via GenAI | AI offers contextual training and manual access to technicians in the field. |

| 15 | Energy Theft Detection & Fraud Monitoring | AI flags anomalies indicating unauthorized usage. |

| 16 | Grid Simulation & Digital Twins | Digital models for scenario planning and resilience testing. |

| 17 | Agentic AI Workflows for Distribution Planning | Systems like PowerChain enable AI to architect complex grid analysis autonomously. |

| 18 | Prosumers & Blockchain-Backed Energy Trading | Combining AI with blockchain to enable decentralized peer-to-peer transactions. |

| 19 | Energy Usage Disaggregation for Buildings | AI pinpoints device-level consumption to optimize efficiency. |

| 20 | Digital Twin Risk Simulation | Platforms like Neara help forecast vegetation and weather risk impacts on grid infrastructure. |

| 21 | Vegetation Management via AI & Satellite Imagery | AiDash and others use AI to reduce costs and wildfire risks in tree trimming. |

| 22 | Cloud-based DER Integration Platforms | SaaS solutions for integrating and monitoring distributed energy resources. |

| 23 | Building-level Energy Insights for Utilities | Tools like Verdigris monitor facility energy usage and inform utility programs. |

| 24 | Smart Meter Analytics & Demand Response | Companies like Itron use AI to manage load and drive customer engagement. |

| 25 | Hydrogen Network and Future Scenario Planning | Simulations for integrating hydrogen into future energy mixes using AI-enhanced models. |

This proliferation of possibilities is precisely why a new structured evaluation model is needed to enable utilities to prioritze: without a consistent framework to score and compare initiatives, utilities risk chasing novelty rather than value, missing the chance to align AI adoption with their core business priorities and regulatory mandates.

The Value Framework

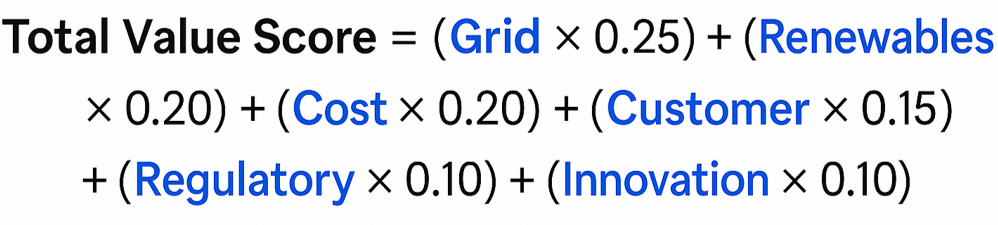

The Utility-AI Value Framework is designed to answer that dilemma. It evaluates AI and GenAI applications across six dimensions. Each focus area is provided with an initial base weight here to reflect its relative importance to utility performance and public mandate:

- Grid Efficiency and Reliability (25 percent)

Grid reliability is the cornerstone of the utility business model. In the United States, outages already cost the economy an estimated $150 billion annually. [2] AI promises to reshape this domain. Predictive analytics applied to sensor data can forecast transformer failures before they occur. Machine vision drones can autonomously inspect transmission lines, reducing reliance on manual patrols. Advanced reinforcement learning models can optimize real-time dispatch decisions, increasing efficiency in congested networks.

Scoring high in this focus area requires demonstrable reductions in outage duration, frequency, or system losses. For instance, Florida Power & Light’s early use of AI-assisted drones reduced inspection costs and accelerated post-storm restoration—a clear step toward higher resilience. [3] Reliability gains translate directly into regulatory goodwill, customer satisfaction, and avoided economic losses.

- Integration of Renewable Energy (20 percent)

The second focus area reflects perhaps the defining challenge of the twenty-first-century grid: integrating variable renewables. Unlike the dispatchable coal and gas plants of old, solar and wind require sophisticated balancing mechanisms. AI excels here. Deep learning models can predict wind and solar output with sub-hourly precision, enabling more efficient dispatch of flexible resources. [4]

AI-enabled distributed energy resource management systems (DERMS) are another frontier. They orchestrate rooftop solar, behind-the-meter batteries, and EV charging fleets, treating them as aggregated virtual power plants. When layered with generative AI interfaces, operators can ask natural-language questions—“What is the expected ramp at 6 p.m.?”—and receive optimized control strategies. Utilities scoring high in this category are those that use AI not merely to tolerate renewables but to actively unlock higher penetrations.

- Operational Cost Reduction (20 percent)

Utility economics remain under relentless pressure. Inflationary capital costs, interest rate volatility, and fuel price uncertainty make cost efficiency paramount. AI offers relief through predictive maintenance, optimized scheduling, and workforce augmentation. For example, predictive models applied at Duke Energy reduced unplanned maintenance costs by up to 25 percent across gas turbines. [5]

Generative AI adds another dimension: automating document preparation for regulatory filings, rate cases, or compliance reporting. While not as glamorous as real-time grid control, these applications chip away at overhead, freeing staff to focus on higher-value activities.

The framework rewards applications that produce measurable cost savings without sacrificing service quality. A high score here requires both scale (how much cost is addressed) and sustainability (whether savings persist beyond pilot stages).

- Customer Experience and Engagement (15 percent)

Historically, utilities have viewed customer engagement as secondary to infrastructure management. But in the age of prosumers, electrified mobility, and smart homes, customer experience is central. AI-driven personalization enables utilities to tailor rate plans, suggest efficiency upgrades, or nudge EV charging behavior.

Generative AI chatbots, if trained responsibly, can resolve customer inquiries with higher accuracy and empathy than legacy IVR systems. Pacific Gas & Electric, for instance, piloted AI-driven text alerts that improved participation in demand response events, yielding both customer satisfaction and peak load relief. [6]

Applications scoring high in this category not only reduce call center burden but also build trust and engagement—critical for adoption of dynamic rates or distributed programs.

- Regulatory Compliance and Risk Management (10 percent)

Utilities are among the most heavily regulated industries. Compliance with NERC reliability standards, cybersecurity mandates, and decarbonization goals consumes enormous resources. AI can automate compliance monitoring, flag anomalies in real time, and even generate draft filings for regulator review.

Equally critical is risk management. Climate-driven extreme weather requires predictive analytics to map fire risk, flood exposure, or asset vulnerability. California utilities now use AI to assess wildfire ignition probability along transmission corridors, enabling pre-emptive shutoffs and vegetation management. [7]

High scores in this area derive from demonstrable reductions in compliance cost, audit frequency, or risk exposure. While these benefits may be less visible to customers, they are vital for regulatory relations and reputational resilience.

- Innovation and Future-Readiness (10 percent)

The final category looks beyond the immediate horizon. How well does an AI initiative prepare the utility for future disruption—hydrogen blending, distributed microgrids, or AI-driven demand surges from quantum computing? Scoring here reflects strategic optionality.

Examples include pilot programs that test generative AI for grid-planning scenario analysis or sandbox environments where operators can simulate extreme future events. European utilities such as Enel have invested in AI-powered digital twins of entire networks, offering a proving ground for future-readiness. [8] Though weighted only at 10 percent, this category matters disproportionately for leadership positioning. It ensures utilities remain explorers, not laggards.

Each proposed application is scored on a scale of 1 to 5, where 1 equals minimal impact and 5 equals transformative impact. A weighted total value score is then calculated:

This quantitative rubric helps utilities compare otherwise disparate initiatives. For example, how does an AI-driven outage management system compare to a GenAI-powered regulatory assistant? By forcing both onto the same evaluative plane, the framework creates a rational basis for prioritization.

Table 2 shows how each of the top 25 utility AI applications might score by each value dimension.

Table 2

Utility-Specific Weightings

The initial “base weights” (25/20/20/15/10/10) are really just a default compass—a conceptual starting point. In practice, each U.S. utility will recalibrate those weights depending on its geography, asset mix, regulatory environment, and strategic objectives. Here’s how that might play different utility types operating in different market contexts.

- Investor-Owned Utilities (IOUs) in Competitive Markets

- Higher weight on Operational Cost Reduction (25–30 percent) because shareholder pressure makes O&M efficiency paramount.

- Customer Engagement also rises (20 percent) since competitive suppliers often encroach, forcing IOUs to differentiate through service.

- Regulatory Compliance may drop to 5–7 percent in states with lighter oversight.

Example: Exelon in PJM territory—cost control and customer programs like demand response are front-loaded.

- Public Power and Municipal Utilities

- Customer Experience carries heavier weight (20–25 percent) because these utilities are owned by the communities they serve.

- Reliability stays high, but Innovation is sometimes less emphasized unless city councils or boards make it a priority.

Example: Sacramento Municipal Utility District (SMUD)—customer-centric with aggressive decarbonization pilots, but balanced by affordability mandates.

- Rural Electric Cooperatives

- Reliability can be weighted as high as 35 percent given the dispersed geography and vulnerability to outages.

- Renewable Integration also rises if local co-ops are pursuing community solar.

- Cost Reduction matters but is constrained by limited capital budgets.

Example: Tri-State G&T in the Mountain West—focus on reliability and renewables integration.

- Utilities in High-Renewables States (e.g., California, New York, Hawaii)

- Renewable Integration may jump to 30 percent or more, since curtailment, storage, and DER orchestration dominate.

- Regulatory Compliance also rises (15 percent) due to stringent climate mandates.

- Reliability remains critical, but it’s often framed around resilience against wildfires, hurricanes, or storms.

Example: Hawaiian Electric—renewable integration is existential, with AI pilots focused on DERMS and forecasting.

- Utilities in Deregulated vs. Regulated Markets

- Deregulated markets: Trading and cost optimization score higher; compliance lower.

- Vertically integrated, regulated utilities: Regulatory & risk management (15–20 percent) becomes central, since commissions scrutinize every AI investment for prudence.

Table 3 summarizes the proposed weights by utility type and market context.

Table 3

| Utility Type | Grid Reliability | Renewables | Cost | Customer | Compliance | Innovation |

|---|---|---|---|---|---|---|

| Base Framework (Conceptual) | 25% | 20% | 20% | 15% | 10% | 10% |

| IOU in Competitive Market | 20% | 15% | 30% | 20% | 5% | 10% |

| Public Power / Municipal | 25% | 20% | 15% | 25% | 5% | 10% |

| Rural Electric Cooperative | 35% | 20% | 15% | 10% | 10% | 10% |

| High-Renewables States (CA, HI, NY) | 20% | 30% | 15% | 10% | 15% | 10% |

| Regulated Utility | 25% | 15% | 15% | 10% | 20% | 15% |

Different Priorities

Translating abstract value scores into actionable priorities requires sensitivity to context. No two utilities face the same pressures: an investor-owned utility competing in deregulated markets, a municipal provider accountable to its community, a rural cooperative balancing reliability and budget, or a regulated monopoly under commission oversight will each judge AI investments through a different lens. To capture these nuances, the framework has been recalculated across six weighting scenarios—one base model and five utility archetypes.

Table 4 shows how the same 25 AI and GenAI use cases rise or fall in priority depending on whether the emphasis is cost control, renewable integration, customer engagement, reliability, compliance, or future-readiness.

Table 4

| Utility Type | Rank | Use Case | Score | Notes |

|---|---|---|---|---|

| Base Framework (Conceptual) | ||||

| — | 1 | Virtual Power Plants (VPPs) | 3.65 | |

| — | 2 | Predictive Maintenance | 3.55 | |

| — | 3 | Dynamic Line Rating (DLR) | 3.50 | |

| — | 4 | Grid Simulation & Digital Twins | 3.35 | |

| — | 5 | Cloud-based DER Integration Platforms | 3.25 | |

| IOU in Competitive Market | ||||

| — | 1 | Predictive Maintenance | 3.65 | |

| — | 2 | Virtual Power Plants (VPPs) | 3.55 | |

| — | 3 | Smart Meter Analytics & DR | 3.30 | |

| — | 4 | Dynamic Line Rating (DLR) | 3.25 | |

| — | 5 | Cloud-based DER Integration Platforms | 3.15 | |

| Public Power / Municipal | ||||

| — | 1 | Virtual Power Plants (VPPs) | 3.70 | |

| — | 2 | Smart Meter Analytics & DR | 3.40 | |

| — | 3 | Predictive Maintenance | 3.35 | |

| — | 4 | Dynamic Line Rating (DLR) | 3.30 | |

| — | 5 | Grid Simulation & Digital Twins | 3.15 | |

| Rural Electric Cooperative | ||||

| — | 1 | Dynamic Line Rating (DLR) | 3.80 | |

| — | 2 | Virtual Power Plants (VPPs) | 3.75 | |

| — | 3 | Predictive Maintenance | 3.70 | |

| — | 4 | Grid Simulation & Digital Twins | 3.55 | |

| — | 5 | Demand Forecasting & Load Management | 3.35 | |

| High-Renewables State (CA/HI/NY) | ||||

| — | 1 | Virtual Power Plants (VPPs) | 3.75 | |

| — | 2 | Dynamic Line Rating (DLR) | 3.60 | |

| — | 3 | Grid Simulation & Digital Twins | 3.50 | |

| — | 4 | Cloud-based DER Integration Platforms | 3.45 | |

| — | 5 | Predictive Maintenance | 3.30 | |

| Regulated Monopoly Utility | ||||

| — | 1 | Dynamic Line Rating (DLR) | 3.60 | |

| — | 2 | Predictive Maintenance | 3.55 | |

| — | 3 | Virtual Power Plants (VPPs) | 3.50 | tie |

| — | 3 | Grid Simulation & Digital Twins | 3.50 | tie |

| — | 5 | Digital Twin Risk Simulation | 3.25 | |

Note: “tie” indicates identical scores sharing the same rank.

The early read of the Utility-AI Value Framework tells a clear story: some bets travel well, others depend on the terrain. Across archetypes, virtual power plants rise to the top because they knit together renewables, demand flexibility, and customer participation—especially in high-renewables states and municipals where DERs are already part of the fabric. Predictive maintenance is the quiet constant: whether you’re a competitive IOU chasing O&M efficiency, a municipal defending reliability, or a regulated utility answering to commissions, keeping assets healthy and outages rare never goes out of style.

Where context bites, it does so decisively. Dynamic Line Rating leads in rural co-ops and regulated monopolies, a least-cost way to unlock capacity when new wires are hard to build. Digital twins emerge as strategic rather than tactical—valued for scenario testing, resilience modeling, and long-range planning, with different emphases by market and governance. Competitive IOUs gravitate to smart meter analytics and demand response to differentiate on customer experience; municipals lift community-facing tools; high-renewables states double down on orchestration platforms; rural systems favor forecasting and efficiency to stretch scarce capital.

The pattern that remains after the noise: VPPs, predictive maintenance, and DLR are the foundational moves. Digital twins—and, in some settings, smart meter analytics—become the differentiators, reflecting each utility’s mix of regulation, market pressure, and resource variability.

Conclusions

How does this framework compare to existing industry roadmaps? The U.S. Department of Energy’s AI for Science, Energy, and Security strategy emphasizes national competitiveness but lacks a utility-specific scoring model. [9] EPRI’s AI Use Case Taxonomy catalogues applications but does not prescribe prioritization. [10] European regulators often emphasize carbon intensity metrics. This Value Framework complements these by offering a flexible, utility-centric tool that aligns technology evaluation directly with business and regulatory imperatives.

No framework is without caveats. Three limitations stand out:

- Data Quality and Bias: AI models are only as good as their training data. Utilities must confront gaps in sensor coverage, cybersecurity risks, and potential biases in historical outage data.

- Workforce Transition: Adoption requires reskilling engineers and operators. AI augmentation must avoid alienating seasoned staff.

- Regulatory Acceptance: Not all regulators may trust AI-driven decisions, particularly if explainability is limited. Building confidence will require transparent pilots and rigorous testing.

Moreover, generative AI carries additional risks: hallucinations, privacy concerns, and intellectual property ambiguity. Utilities must tread carefully, adopting governance frameworks that ensure responsible deployment.

The electric utility has always been more than wires and substations; it is a public trust. AI and GenAI, properly applied, can help utilities honor that trust in an era of profound change. The Value Framework outlined here offers a conceptual starting point. By scoring initiatives across efficiency, renewables, cost, customers, compliance, and future-readiness, utilities can prioritize wisely, balance innovation with prudence, and remain adaptive in a shifting landscape.

This is not a finished product but an invitation—to utilities, regulators, and innovators alike—to test, refine, and iterate. As history has shown, those who embrace structured experimentation often emerge as leaders in the next chapter of energy.

Join the AI×Energy Community — Before You’re Playing Catch-Up

The digital infrastructure revolution is not just moving fast—it is rewriting the rules of energy, finance, and technology in real time. If this deep dive into data-center finance opened your eyes, imagine having direct access to the next wave of intelligence before it hits the headlines.

Subscribe to AI×Energy—free—for the same insider-level analysis, exclusive briefings, and system-level roadmaps trusted by leaders in energy, AI, and infrastructure. You will be joining hundreds of executives, investors, and technologists who rely on AI×Energy to anticipate capital flows, decode regulatory shifts, and spot the hidden forces shaping tomorrow’s grid.

Do not read about the future secondhand—subscribe to the playbook.

Notes

- U.S. Energy Information Administration. Annual Energy Outlook 2024. Washington, D.C.: U.S. Department of Energy, 2024.

- U.S. Department of Energy. Economic Benefits of Increasing Electric Grid Resilience to Weather Outages. Washington, D.C.: DOE, 2013.

- Florida Power & Light. “Drone Technology and Storm Response.” FPL Technical Brief, 2021.

- National Renewable Energy Laboratory. Machine Learning for Solar Forecasting. Golden, CO: NREL, 2020.

- Duke Energy. “Predictive Maintenance Case Study.” 2022. https://www.dukeenergy.com.

- Pacific Gas & Electric. “AI-Driven Customer Engagement in Demand Response.” PG&E Pilot Report, 2021.

- California Public Utilities Commission. Wildfire Mitigation and AI Analytics. Sacramento, CA: CPUC, 2022.

- Enel Group. “Digital Twin Innovation for the Grid.” 2022. https://www.enel.com.

- U.S. Department of Energy. Artificial Intelligence for Science, Energy, and Security: A Strategic Plan. Washington, D.C.: DOE, 2020.

- Electric Power Research Institute (EPRI). AI Use Case Taxonomy for the Electric Power Sector. Palo Alto, CA: EPRI, 2021.