The Age of Compute: How AI and Data Centers Rewired Global Energy Investment

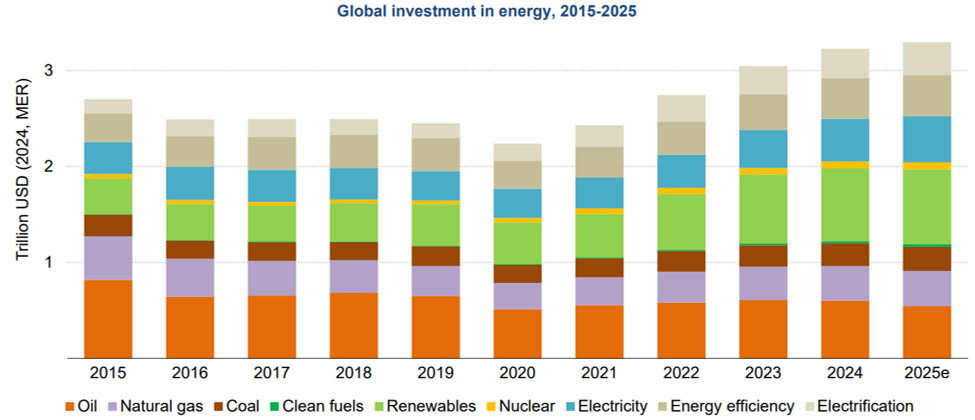

Global energy investment hits $3.3 trillion in 2025, with two-thirds ($2.2 trillion) now flowing to clean energy. The IEA warns that AI and data centers are reshaping demand, potentially consuming 1,000 TWh by 2030 and driving a new “Age of Electricity and Intelligence.”